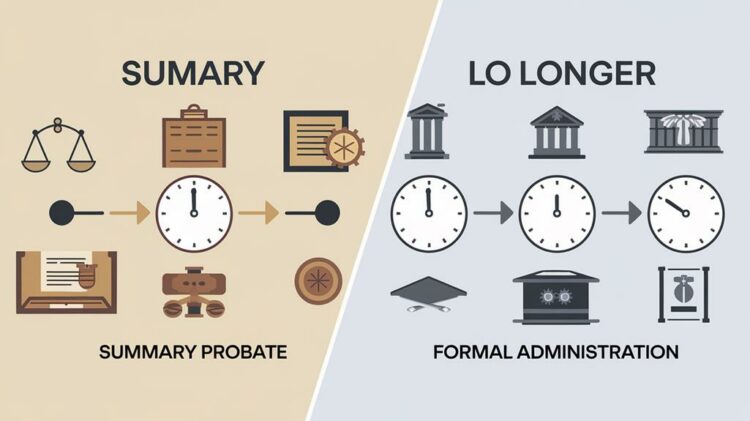

When someone dies in Florida, dealing with their estate can be confusing. You might be unsure whether to use summary probate administration or formal administration.

Summary administration is a faster option if the dead person’s estate is worth less than $75,000 or if they died more than two years ago. This method is usually quicker, with fewer legal steps and no need for someone to represent the estate.

However, how is it different from formal administration, and which one should you choose? There are big differences and important things to think about from the start of the probate process.

Key Takeaways

- Summary probate is for smaller estates: under $75,000 in Florida and $50,000 in New York. It costs less and needs fewer forms.

- Formal probate is for bigger estates: over $75,000 in Florida. It has more steps and gives the estate manager more power.

- Summary probate is usually quicker, taking 3-6 months. Formal probate takes longer, 6-18 months, because it’s more complex.

- Formal probate involves the court more. A person is chosen to manage the estate and handle money owed.

- In summary probate, the court does less. Property goes straight to the heirs, making it simpler.

Summary Probate Administration Eligibility

To see if your family member’s estate can use Simplified Probate Administration, you need to check how long it’s been since they died and how much their probate assets are worth.

If the estate’s value is less than a certain amount set by your state, often between $50,000 and $100,000, you might be able to use this easier process. Simple probate usually needs less paperwork and fewer trips to court, making it quicker and cheaper.

For example, in Florida, the estate must be worth less than $75,000 to use summary administration. In New York, estates with less than $50,000 in personal property can use it.

These quicker methods mainly focus on how to give out assets and help you save time and money. Knowing these rules can help you handle probate faster and make it easier to share your family member’s belongings.

Simplicity and Speed Efficiency

Using a simpler probate process can greatly cut down on time and work needed to handle your loved one’s estate. Summary administration gives you clear benefits in terms of speed and efficiency.

| Efficiency Area | Advantage |

|---|---|

| Lower Cost | Less money spent on legal fees, management, and court costs. |

| Less Paperwork | Fewer forms to handle and turn in, making the work easier. |

| Quick Finish | Usually done in a few months, unlike regular probate that can take over a year. |

| Less Court Time | Courts are less involved, letting you give out assets with fewer legal steps. |

This faster way through probate helps you finish sooner, which can lessen the emotional stress often linked to long estate handling. By picking summary administration, you can quickly settle your loved one’s estate, give out assets as planned, and move on more easily and clearly.

No Personal Representative Needed

No Personal Representative Needed

In summary administration, no personal representative is needed to handle the process. The court directly tells who gets what assets. This makes things simpler and faster.

Without a middleman, the court can give out assets more quickly. There’s less paperwork and fewer steps because no one has to oversee the sharing of assets. The court does it all, which speeds up the whole process.

Formal Administration Requirements

You usually need a formal administration, with a judge and a personal representative, if the estate doesn’t qualify for a summary administration. This type of administration is required when someone dies owning more than $75,000 in assets that must go through probate. Probate assets include personal bank accounts, cars, houses, and other belongings that are only in the dead person’s name, as well as any money they owe.

- Petition for Administration: The probate lawyer files a request with the Florida Probate Court, collecting all needed papers and details to officially start the estate process.

- Asset Identification and Debts: The personal representative finds and gathers assets, tells creditors about the death, and handles any debts owed.

- Asset Distribution: The personal representative gives out assets based on the will or Florida laws after all debts and taxes are paid.

- Closing the Estate: The lawyer files a request to end the estate, and the judge signs a paper that releases the personal representative from their job and finishes the estate process.

The formal administration makes sure all creditors are told and that assets are given out according to the dead person’s will and/or state law.

Creditor Notification and Claims

After the personal representative lists all assets, a key step is telling known and possible creditors about the estate and how to make claims. This is important because creditors have specific rights to ask for money within certain time limits.

| Condition | Notification Period |

|---|---|

| Known Creditor | 4 months from letters of administration or 30 days from finding out about the creditor |

| Late Claims Allowed | 60 days after learning about the person’s death or 60 days after knowing about the claim |

Creditors must file claims within the set time to be looked at. The personal representative must make sure notices are sent on time and properly. If creditors are not told, late claims might be allowed.

Creditors can file claims, even if they were not told about the death. Spouses who are creditors may be able to make late claims for certain money-related wrongs, but these claims must be made within 60 days of learning about the person’s death.

Longevity of the Probate Process

The probate process can last from a few weeks to many years, based on how complex the estate is and what arguments happen. As you go through this legal process, it’s important to know how long it might take. This helps you plan and deal with the people who’ll get money or things from the estate, as well as those the estate owes money to.

Summary Administration: This usually takes 3 to 6 months. It’s faster and easier for estates with simple assets, like those worth less than $75,000.

Formal Administration: This longer process usually takes 6 to 18 months. It involves more steps, like court appointments and more paperwork.

Typical Timelines: In Florida, formal probate can take up to two years. Summary administration can last from three months to two years.

Delays from Arguments: Probate can take much longer if people argue, leading to long court fights. How you handle relationships and make choices can really affect how long probate takes.

Knowing these timelines helps you adjust and handle the estate better, which is good for you and your family.

Frequently Asked Questions

Frequently Asked Questions

Can a Summary Administration Be Converted to a Formal Administration?

It’s possible to change a summary administration into a formal administration. To do this, you need to send a request to the probate court. People often need to make this change if they find more assets worth over $75,000 or if family members start arguing about the estate. The court will review your request and decide if the change is needed.

Do Beneficiaries Pay Taxes on Inherited Property in Summary Administration?

Generally, as someone who inherits property in a summary administration, you won’t pay taxes on the inherited property right away. But you should think about taxes on long-term capital gains if you decide to sell the property later.

Can Non Resident / Out of State Probate Petitioners Start Summary Administration?

Yes, as a nonresident heir, you can start a Summary Administration if:

- Florida assets are worth less than $75,000, or

- The person died over two years ago

You must also deal with how to share out the assets.

Is an Executor Entitled to Compensation in a Summary Administration?

In short form administration, you as the executor may not get paid like in regular probate. Your job is to give out assets, handle people the estate owes money to, and close the estate. The court doesn’t check how much you get paid.

Can an Insolvent Estate Still Use Summary Administration?

When an estate doesn’t have enough money, you can still use summary administration. But you need to carefully manage the claims from people the estate owes money to. You must make sure all debts are counted before giving out any assets.

Conclusion

Choosing between summary and formal probate administration in Florida depends on your specific situation. Summary administration is faster and simpler, ideal for estates under $75,000 or when the person died over two years ago. It doesn’t require a personal representative and usually takes 3-6 months. Formal administration, on the other hand, is necessary for larger estates, involves more court oversight, and typically takes 6-18 months. Both processes have their own rules for notifying creditors and distributing assets.

Navigating probate can be complex, whether you’re dealing with summary or formal administration. At Real Estate Law FL, we specialize in guiding you through this process, ensuring you meet all legal requirements and deadlines. Don’t let the complexities of probate overwhelm you. Let our experienced team help you choose the right administration method and handle your loved one’s estate efficiently and legally. Visit Real Estate Law FL to learn more about our probate services. You can also email us or call us to schedule a consultation and get the expert guidance you need during this challenging time.